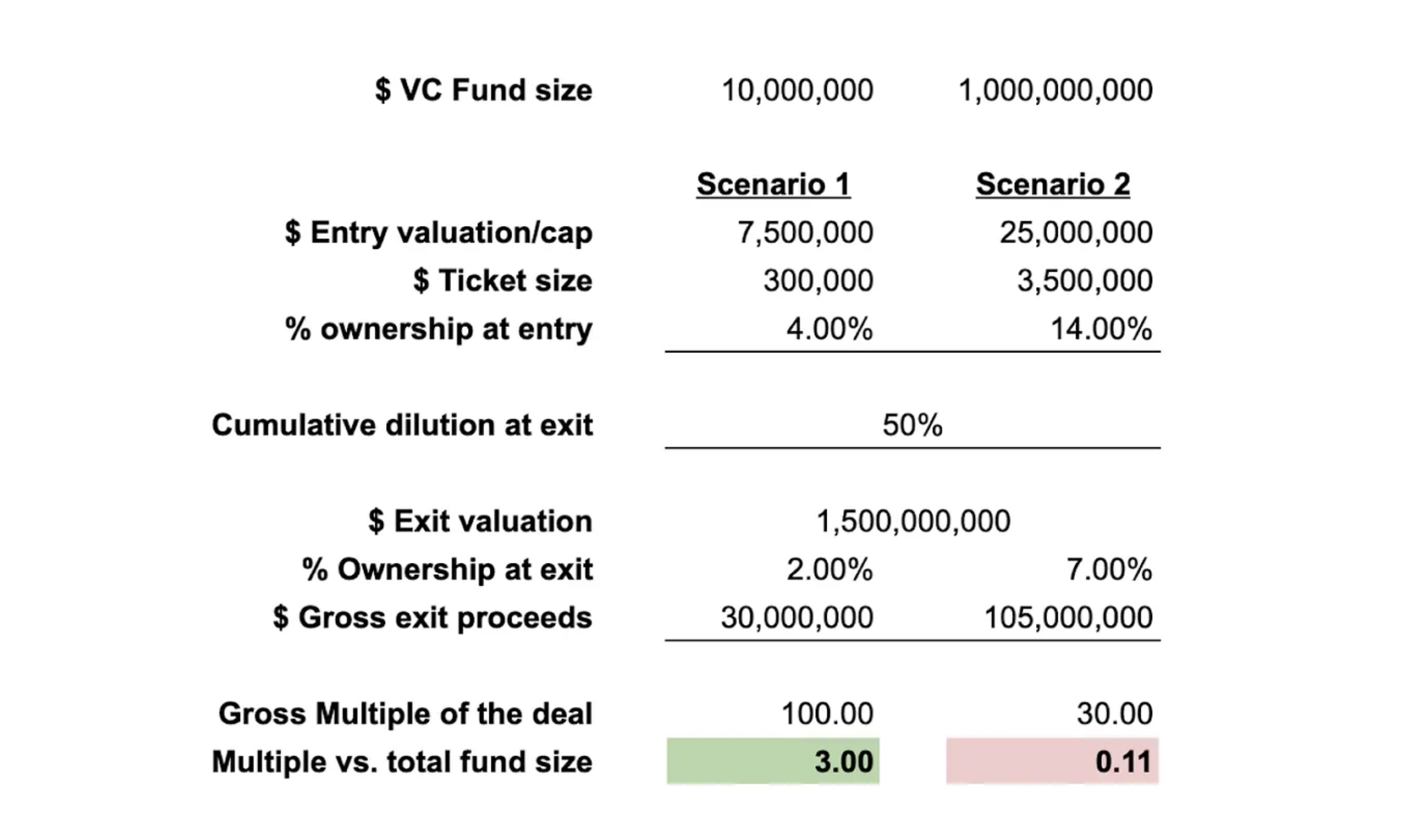

Family offices evaluating venture capital as LPs have to understand how quantitative dynamics is crucial to making informed allocations.

ReadVertices Capital is your OCIO Partner for bespoke venture capital strategies. Assess your readiness, discover opportunities, and deploy with confidence in venture capital.

Vertices Capital specializes in OCIO 100% dedicated to Venture Capital, partnering with small family offices, independent asset managers, endowments, pension funds, and banks. We help you understand the venture capital landscape, build bespoke investment strategies, and execute them with precision.

We believe the best enduring managers have strong and multi-decade partnerships, with shared values and commitment to responsible business practices.

Deep local knowledge in Europe, and in the US. We understand regional markets, regulations, and opportunities and are expanding our coverage to new geographies.

We provide strategic guidance, network access, and ongoing support to help family offices, banks, endowments, pension funds, and asset managers develop responsibly their VC strategy.

Looking to start or develop your Venture Capital investment strategy? We offer education, guidance and sourcing, implementation, monitoring and support to your VC strategy.

Explore the venture capital ecosystem and emerging trends.

Your readiness assessment →Custom VC investment strategies aligned with your goals,and seamless deployment and ongoing management of VC portfolios.

First, evaluate your VC-readiness →Simple, transparent, end-to-end.

Book a free 45-minute assessment to discuss your VC fit and readiness.

We evaluate your set-up, the VC asset class investment opportunity in alignment with your team, culture, and objectives.

We work together to structure your VC investment strategy and plan your journey.

Active engagement with guidance, introductions, and strategic support pre- and post-investment.

Add your VC firm to our active network and explore fundraising and new LP partnership opportunities.

Trends, strategies, playbooks, perspectives. 100% Venture Capital.

Our insights are also available as podcasts.

Stay updated with our latest articles on venture capital trends, strategies, and perspectives.

Family offices evaluating venture capital as LPs have to understand how quantitative dynamics is crucial to making informed allocations.

Read

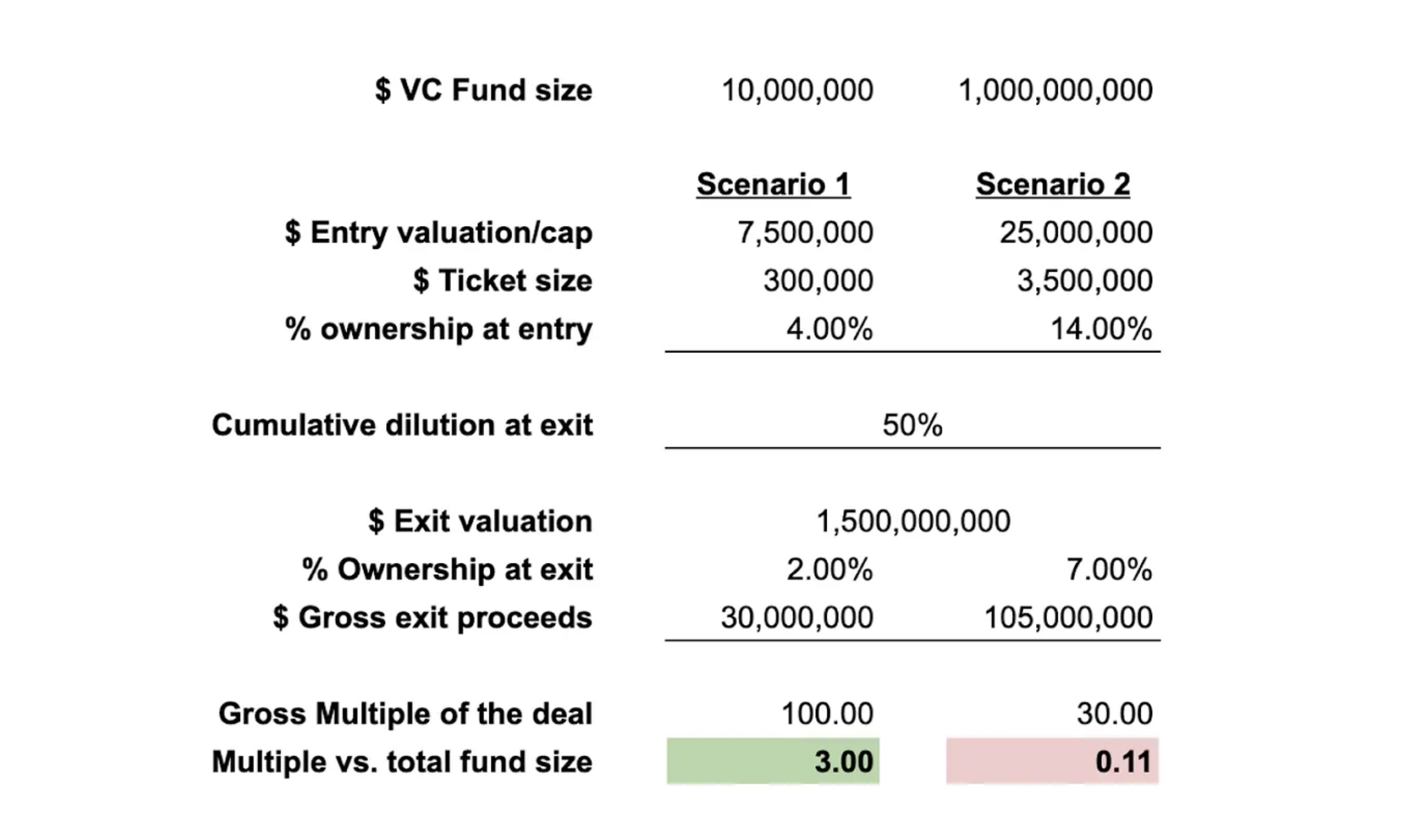

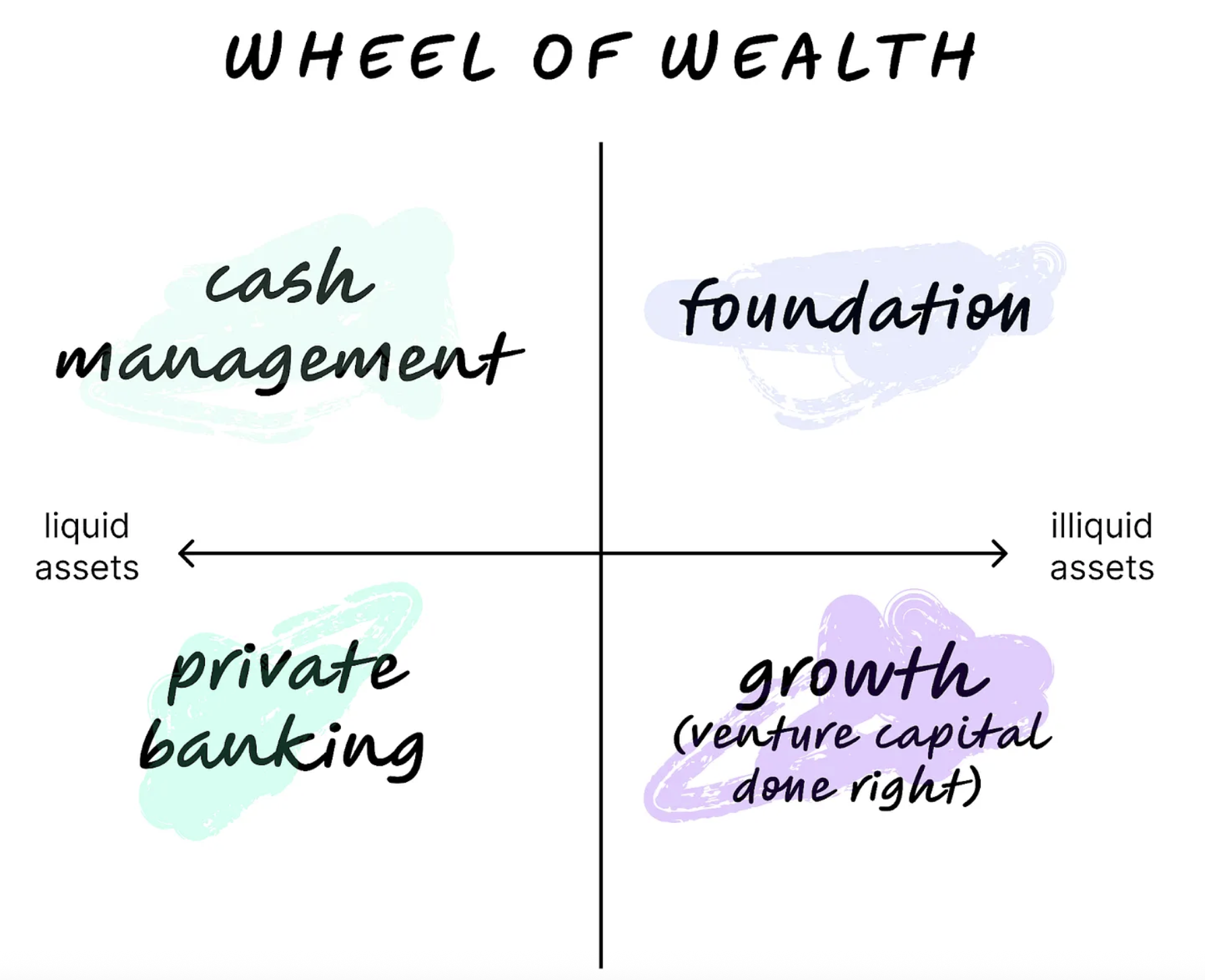

For family office LPs, a clear assessment of both unsystematic and systematic risks is essential when building a venture capital portfolio.

Read

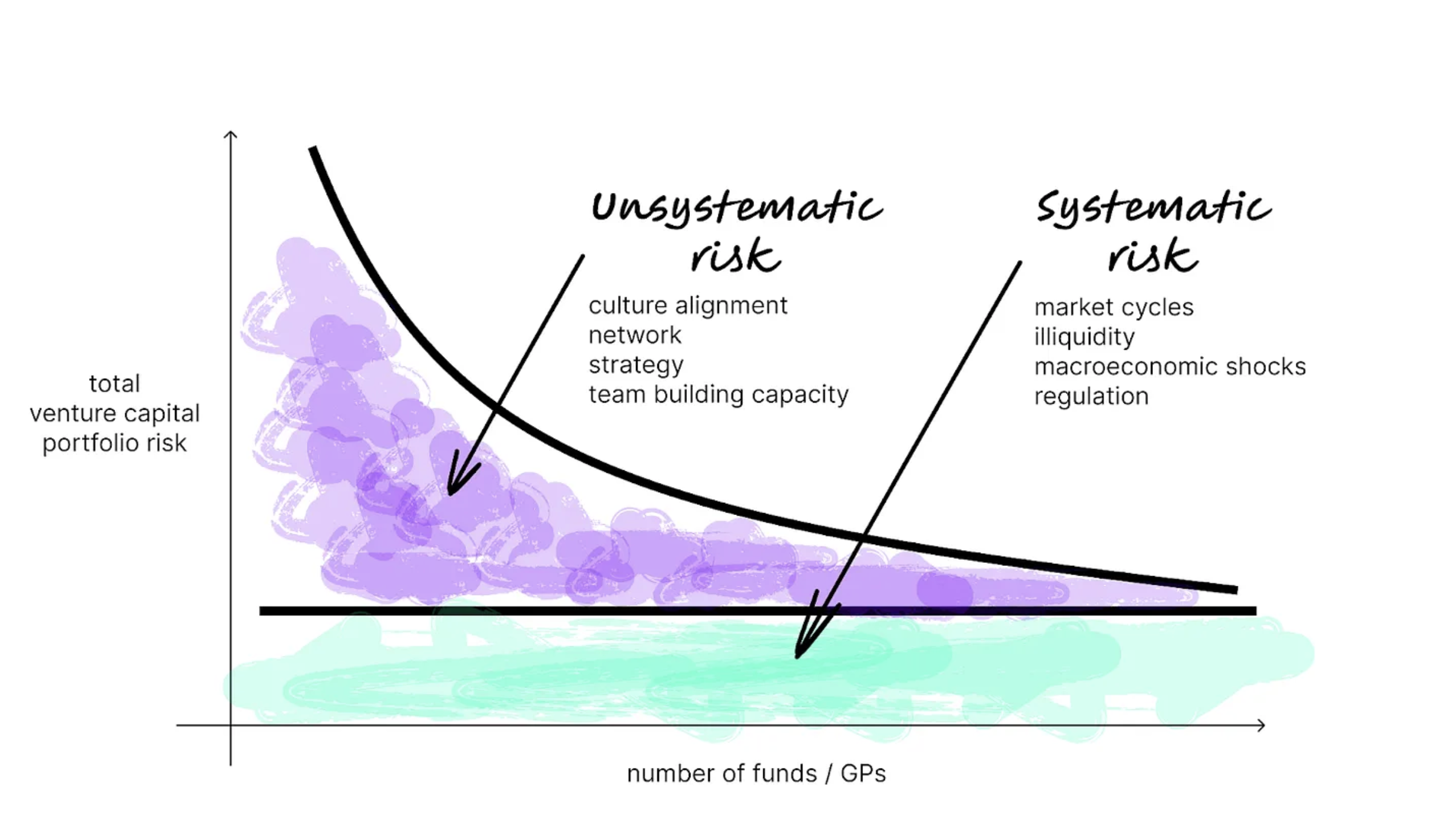

Private banking plays a vital role in the "Wheel of Wealth", but..

ReadInvesting in Venture Capital requires the right approach and mindset. We guide family offices to invest in venture capital with foresight and a prepared mind. Fill out the form below to express interest and get our whitepaper "Unlocking the Power of Venture Capital for Family Offices".

This operational blueprint, emphasizing the necessity of courage and the unwavering pursuit of asymmetric upside, is directly inspired by the proven methodologies of the legendary venture capital firm, Sequoia Capital. Fill out the form below to express interest and get our whitepaper "101 Venture Capital Core Principles for New LPs Willing to Understand how VC Really Works".